In 2022, the Dubai Health Authority (DHA) introduced a mandate to enforce value-based care in the UAE, with the objective of achieving better health outcomes and lower costs.

“Almost all women living in this region have vitamin D deficiency due to lack of exposure to sunlight ... Unrecognized vitamin D deficiency can lead to fractures, cardiovascular problems and even cancer."

Dr. Humeira Badsha, Consultant Rheumatologist - Dubai

We provide value-based, preventive women's health add-ons that prioritise the needs and health outcomes of women, plugging gaps in the existing healthcare ecosystem, and reducing the number and cost of claims over time.

Even with comprehensive health insurance, you might consider a women’s health add-on for your employees – and especially any insured under the Essential Benefits Plan (EBP) – for the following reasons:

Greater Choice and Flexibility: Our women’s health add-ons provide access to a wider network of specialists beyond those covered as part of the “lite” network associated with the Essential Benefits Plan. This enhanced network allows your employees to choose the doctor they prefer, potentially leading to better care and faster diagnoses.

Personalised Care: Women’s health is notoriously under-researched and underfunded (WHO). This results in worse health outcomes for women overall. The person-centered approach of our women’s health add-ons means that employees are able to access care that is better suited to their lifestyle and responsibilities, as well as to things like care coordination, where a dedicated professional helps them to navigate their health journey. This can be invaluable for those managing chronic conditions or complex medical situations.

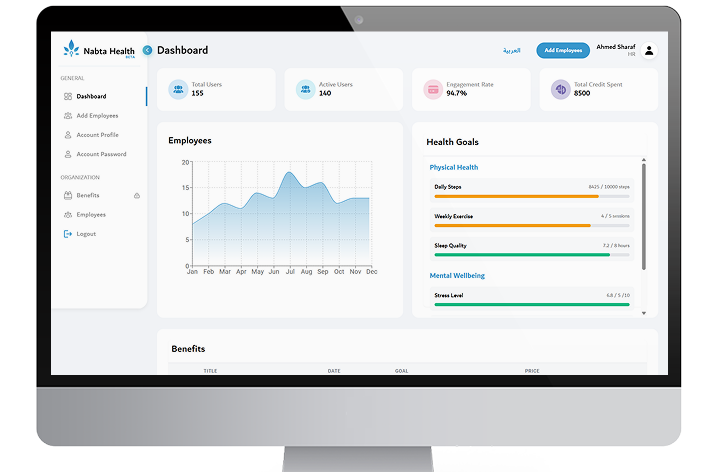

Tech-powered Convenience: Our women’s health add-ons offer access to the NABTA mobile app for appointment booking, health record management, and support with claims denials. This saves your employees time, reduces their stress levels, improves their concentration, and simplifies healthcare administration.

Preventive Focus: Our women’s health add-ons put a strong emphasis on preventive care and using dietary and lifestyle choices to address pre-existing conditions. They also offer enhanced access such as telehealth consultations and annual, multi-specialty health checks. This proactive approach helps identify health issues early and keeps your employees healthier in the long run, which in turn contributes positively to workforce engagement and productivity.

Cost Management: While there’s an additional cost associated with any add-on, our women’s health add-ons offer benefits like significant discounts on interventions, and assurance about the quality and capabilities of practitioners. The add-ons also provide coverage for treatments often excluded from insurance premiums, and the Essential Benefits Plan in particular, such as the removal of polyps, cysts and fibroids. The ability to access essential medical interventions in a timely and cost-effective manner offers significant benefits to your employees, and will also reduce the likelihood of your insurance premiums increasing at the time of renewal.

In short, our multi-specialty, person-centered, technology-enabled women’s health add-ons can give your employees more control over their healthcare experience, and allow you as an employer to take positive and proactive steps to enhancing their health and wellbeing in and outside of the workplace.

Recommended for: employees earning less than AED 4,000/month and insured under the Essential Benefits Plan.

You can calculate the total estimated savings associated with our insurance add-ons and return on investment for your company by using our ROI calculator.

We take a few key numbers – the number of full-time employees (FTEs) in your company, the percentage of female employees, the average salary of your employees, and your average per capita spend on health insurance – and use these to calculate your total savings at an individual, provider, and insurance level.

Our women’s health add-ons are designed to enable the early detection, diagnosis, and ultimately prevention of chronic and non-communicable diseases, which today are responsible for the majority of the global disease burden (WHO).

By empowering women to effectively manage their own health and become the primary architects of their own care journey, we reduce their dependency on external interventions and prescriptions. This ultimately improves health outcomes and helps to lower costs over time.

No, for you as an organisation, there are no additional costs beyond the initial upfront costs of the MicroCare add-ons.

For your employees, there are additional costs associated with the essential medical interventions that form part of the MAXI MicroCare Add-On.

The essential medical interventions that are fully covered as part of the MAXI MicroCare Add-On are as follows:

For the following interventions, employees will be required to pay the following additional amounts:

As well as the procedures themselves, all essential medical interventions include:

All additional sums are payable in up to 4 installments through tabby.

Please note: it is common for these interventions to be excluded from traditional health insurance on the basis that they are often (mis)classified as pre-existing conditions. If employees are required to pay for these out-of-pocket, the prices typically range from AED 20,000 – 35,000 per procedure.

Please call or WhatsApp the NABTA clinical team on +971 4 394 6122 to learn more.

The NABTA PLUS subscription includes a host of technology-enabled and in-person services, including access to a 24/7 nursing hotline, emergency walk-in clinics, out of hours services, monthly virtual check-ins with your care coordinator, member-only events and discounts, and much more.

These services are designed to provide a continuum of care for employees living with chronic or pre-existing conditions, or navigating particular health challenges or stages such as fertility, pregnancy, postpartum and perimenopause.

To learn more about the NABTA PLUS Subscription, please contact customer services on [email protected]

Tell us which best describes you, and we’ll get in touch within 24 hours to discuss next steps.

© Nabta Health Ltd 2017 - 2026